Chart of the month: March 2023

Share this insight

Source: Company reports.

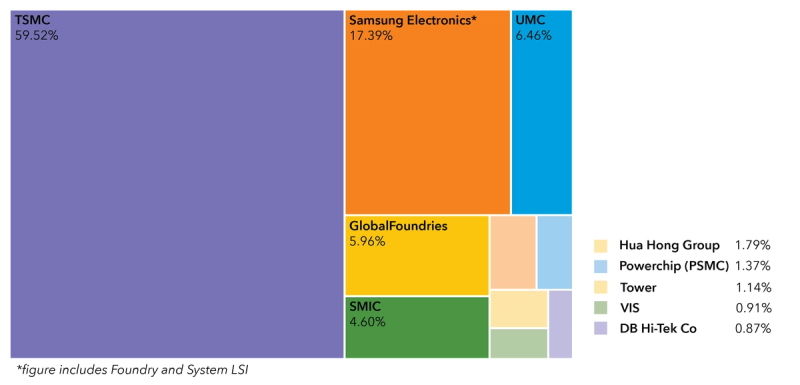

This month’s chart details the market shares of semiconductor foundries based on their revenue in Q4 2022.

For semiconductor foundries, 2022 ended somewhat anticlimactically; many foundries reported lower revenue in Q4 than in Q3, and those who escaped losses saw only incremental increases in revenue quarter on quarter.

The global semiconductor foundry market is dominated by a small number of companies – five foundry businesses comprise over 90% of the total market share. Taiwanese foundry TSMC unquestionably dominates the market, as illustrated by its market share of almost 60%. South Korea’s Samsung Electronics also holds a sizeable market share of over 17%. GlobalFoundries, UMC and SMIC are other key players, but their market shares are less substantial, hovering around 5%.

Around 80% of chip manufacturing takes place in East Asia, as well as over 90% of assembly and testing. This is due in large part to the influence of TSMC, which enjoyed a very successful year, increasing revenue by 42.8% from 2021 to 2022. Its success has made Taiwan a hub of semiconductor manufacturing, and the importance of the country to the chip industry has formed what has come to be known as a ‘silicon shield’ against geopolitical threats.

However, the company’s continued success is potentially being put at risk by the growing drought conditions in Taiwan. Having been hit hard by a supposedly ‘once-a-century’ drought in summer 2021, central and southern Taiwan are once again suffering intensifying droughts, with the government increasing Tainan’s water alert level to orange alert after the country experienced its driest year for 30 years in 2022. For the water-intensive chip industry in Taiwan, this poses a real risk to the security of supply as reservoirs deplete. Industrial suppliers in Taiwan are being asked to reduce their water consumption, a climate resilience-based measure to which TSMC are already committed, targeting a 30% reduction in unit water consumption by 2030.

These challenges could provide opportunities for other foundries to snatch a greater share of the market from TSMC, but these issues also threaten to destabilize the chip supply chain once again. With TSMC claiming over half of the foundry market, its problems could have catastrophic consequences for the semiconductor industry as a whole.

Share this insight