Greenhouse gas emissions efforts turn their attention to the supply chain - End-user sustainability trends revealed

Share this insight

As demand continues to grow in light of recent chip demand, semiconductor manufacturers must balance increasing production with targets to reduce their environmental impact. How successful have they been, and where should they focus their attention next?

Widespread emphasis on protecting the climate has driven ambitious sustainability targets from major semiconductor manufacturers. A key performance indicator is their greenhouse gas (GHG) emissions, which manufacturers disclose annually in corporate responsibility reports. The Greenhouse Gas Protocol divides these emissions into three categories:

- Scope 1 – direct emissions from the manufacturing process

- Scope 2 - indirect emissions from energy consumed

- Scope 3 - indirect emissions from the supply chain

How are major semiconductor companies approaching the challenge of emissions reduction according to their 2024 reports?

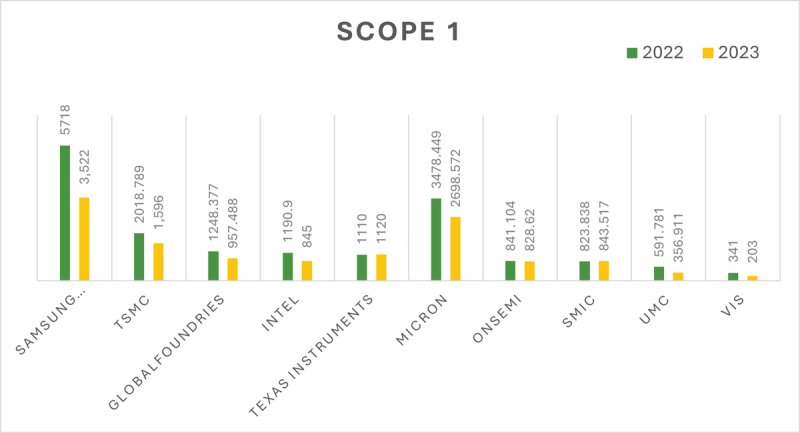

Addressing direct emissions

Reducing direct emissions from semiconductor manufacturing processes is a key sustainability priority, since some process gases have extremely high global warming potential (GWP), such as SF6, NF3, perfluorocarbons (PFCs), and hydrofluorocarbons (HFCs). These fluorinated greenhouse gases (F-GHGs) are vital for etching and chemical mechanical planarization. Data from leading manufacturers’ corporate responsibility reports indicates that they have successfully reduced scope 1 emissions year on year.

Manufacturers are addressing scope 1 emissions through advanced abatement technologies. For example, Samsung’s DS Division installed 16 new regenerative catalytic systems (RCS) in 2023 to treat process gases in pursuit of achieving net zero. Similarly, TSMC introduced low energy consumption and high-efficiency local scrubbers to fabs, achieving a GHG reduction rate of 95% in 2023.

Another approach is to optimize the dosage of said gases –using the minimum amount possible for each process step, companies can reduce the quantity of gas used in production

In addition to abatement and reduction, the search for lower GWP alternatives to replace F-GHGs is beginning to bear fruit. Developing these chemistries allows manufacturers to swap in new tools that do not utilize fluorinated gases. Manufacturer ESG reports highlight these efforts – TSMC’s report highlights a new quality verification initiative by its Chemistry Lab for alternative chemistries poised to replace high GWP substances. GlobalFoundries is exchanging its high GWP heat transfer fluid with a water-based mixture that has no global warming impact for 150 chemical vapor deposition tool chambers by 2025. Likewise, Samsung’s DS Division recently developed a new G1 gas which can replace C4F8.

These measures are particularly timely as legislation is cracking down on fluorinated gas production. For example, the European Union updated its F-gas regulations in March 2024 in preparation for stricter limits on fluorinated gas production. By 2030 the EU Commission will evaluate whether to impose a quota for semiconductor HFC usage, and a new annual reporting format will take effect from March 2025.

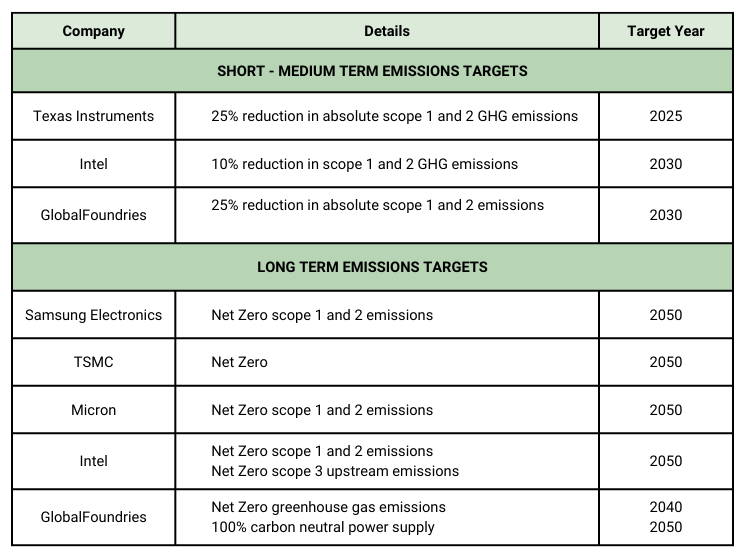

Ambitious targets

In addition to direct emissions from their own operations, semiconductor manufacturers must also account for indirect emissions, which occur at sources owned or controlled by other companies.

Ambitious sustainability goals set by semiconductor companies set in the short to medium term target percentage reductions in absolute scope 1 and 2 emissions by 2030. Long-term goals are even more ambitious, with many manufacturers aiming for Net Zero by 2050.

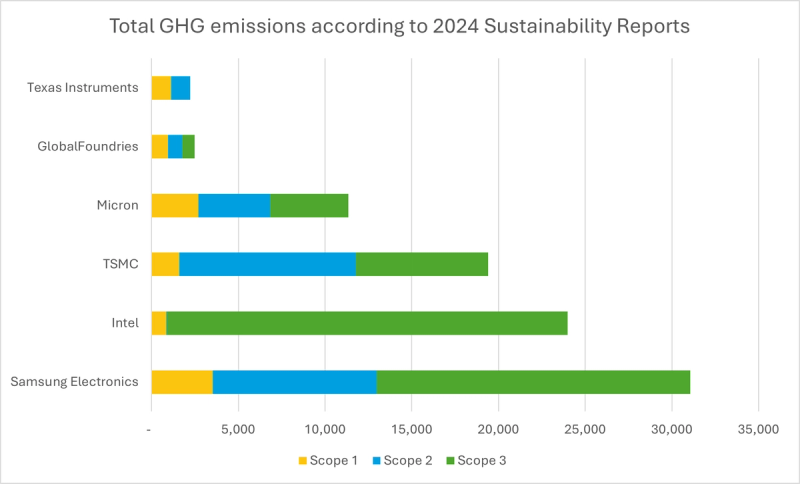

Extending emissions efforts - scope 3

While efforts to reduce scope 1 and scope 2 emissions are in full swing, scope 3 emissions - those associated with the wider value chain - are harder to quantify and to control. Understanding these emissions requires ongoing, extensive work with suppliers, and these efforts are by contrast just beginning. Per the GHG Protocol, scope 3 emissions disclosure is optional compared to the mandatory scopes 1 and 2.

Some major manufacturers such as TSMC, Samsung, and Intel routinely account for scope 3, while others such as Texas Instruments are still developing methods to quantify this emissions category. The growing adoption of scope 3 reporting reflects the need for the semiconductor industry to fully understand its emissions data.

There is no uniform approach to calculating scope 3 emissions – while some companies take a cradle-to-gate approach, accounting for both upstream and downstream emissions, others only account for upstream indirect emissions.

Manufacturers can use frameworks such as the Carbon Disclosure Project (CDP) emissions questionnaire to fully understand their suppliers’ emissions. TSMC goes further, requiring major emission contributors to plan and implement significant carbon reduction before 2030.

In August 2024, the IRDS published a white paper defining scope 3 areas related to semiconductor facility technology decisions, and proposed assessment criteria to pinpoint how decisions indirectly impact the environment. It identified tech gap ‘hotspots’, highlighting ‘High efficiency GHG abatement without fossil fuel combustion’ and ‘Transition to low GWP facilities HTFs/refrigerants’ among the top focus areas.

While semiconductor facilities are effectively working to reduce carbon emissions through measures targeting scopes 1 and 2, there is still plenty to be done in the realm of scope 3, which remains out of reach for some manufacturers. As sustainability initiatives press forward, semiconductor manufacturers will have to work with their suppliers to understand the full breadth of scope 3 emissions and collectively work to control GHG emissions.

Share this insight